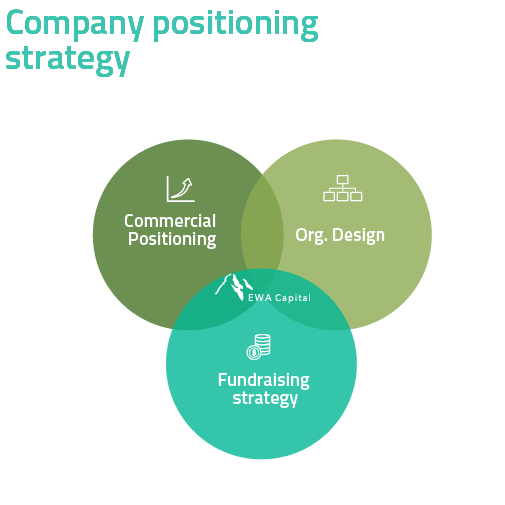

EWA Capital firmly believes that the best way to create value alongside entrepreneurs is through a hands-on approach, in which the Team aims to build a close relationship with entrepreneurs, increasing receptiveness, generating earlier awareness of crucial challenges, and connecting with strategic partners using EWA’s network.

Prior to investment, the Team along with the entrepreneurs establish a plan to solidify the investment thesis and identify specific actions required to build and grow the company to the next level. The plan includes: 1) key hires plan in which the Team provides operational expertise to management by bringing nosiness tools, 2) best practices 3) consolidation of a strong corporate governance and 3) its strong network in order to attract talent and smart capital.

EWA Team is able to build strong relationships with the entrepreneurs, allowing on firsthand the Team to fully understand the company’s ability to create value, follow the performance of the business and its path to growth well in advance of a potential investment. Leveraging from our local and international network, portfolio companies can build relationships with various strategic and financial co-investors.

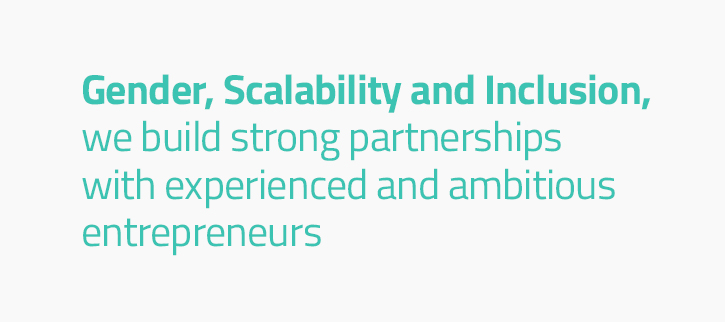

End customer

End customer Gender inclusion

Gender inclusion ESG Policies

ESG Policies Interest alignment

Interest alignment Accountability

Accountability